Blog

SAVE BIG on Capital Gain Taxes, INVEST TODAY in a ROHAN Home!

18 March 2024

Planning to sell your house or something else valuable and make a profit? Heads up!

You might have to pay a tax called Capital Gains Tax.

It depends on how you sold it and what exactly you sold.

Seize this opportunity to SAVE BIG on Capital Gains Tax before March 31st 2024 by minimizing your tax burden and maximizing your ROI.

What is Capital Gains Tax?

Capital Gains Tax is a tax levied on the profit earned from the sale of a capital asset, such as stocks, bonds, or real estate and is applicable in the financial year of the sale transaction.

Under Income Tax Act, there are two types of capital gains –

1) Short-term Capital Gain Tax

Applicable on sale of any asset that is sold in less than 36 months of purchase. In the case of immovable properties, the duration is 24 months. 10-30% tax on profits depending on type of asset and tenure of ownership.

2) Long-term Capital Gain Tax

Applicable on immovable asset that is sold after 36 months of purchase. 20% tax on profits applicable. Movable assets like equities, equity-based Mutual Funds, UTI units, securities, preference shares and zero-coupon bonds are considered as long-term capital asset if they are held for over 12 months.

How to avail Exemption from Capital Gains Tax Before 31st March 2024?

1. Section 54 – Applicable on sale of existing residential property only.

To avail exemption, invest the proceeds of sale in a new residential property or maximum of 2 residential properties.

Note: Capital gains should not be more than INR 2 Crore

2. Section 54F – Applicable on sale of capitals assets excluding residential property.

To avail exemption, invest the proceeds of sale including capital gains in a new residential property within 24 months of sale of the capital asset.

3. Capital Gains Account Scheme, 1988 –

Considering the complexity and time-consuming nature of residential property purchase and tax return filling timelines, exemption can be availed by depositing the capital gains in a Capital Gain Account in any PSU Bank. However, if the capitals gains are not reinvested, the deposit is treated as a short-term capital gain in the year in which the specified period lapses.

4. Section 54EC – Applicable on sale of existing residential property only

To avail, the proceeds of sale of the property are to be invested in specified bonds within 6 months of sale. These bonds have a locking period 60 Months.

Why Should You Invest in a Home Now?

Investing in real estate, particularly residential properties, can offer significant tax advantages when it comes to Capital Gains. For example, homeowners can benefit from the primary residence exclusion, which allows individuals to exclude up to a certain amount of profit from the sale of their primary residence from capital gains tax. Additionally, real estate investments offer opportunities for depreciation deductions and tax-deferred exchanges, further reducing your tax burden.

By investing in a ROHAN Home before the March 31st 2024, reap these tax benefits while building long-term wealth through home ownership.

TOP Blog

SAVE BIG on Capital Gain Taxes, INVEST TODAY in a ROHAN Home!

18 March 2024

Planning to sell your house or something else valuable and make a profit? Heads up!

Western Pune includes the suburbs of Baner, Aundh, Balewadi and Hinjawadi among others. Baner and Aund...

Read More

Baner: Pune’s Lifestyle Hotspot

17 February 2024

What comes to mind when you think of entertainment, cosmopolitan lifestyle and exceptional living in P...

Read More

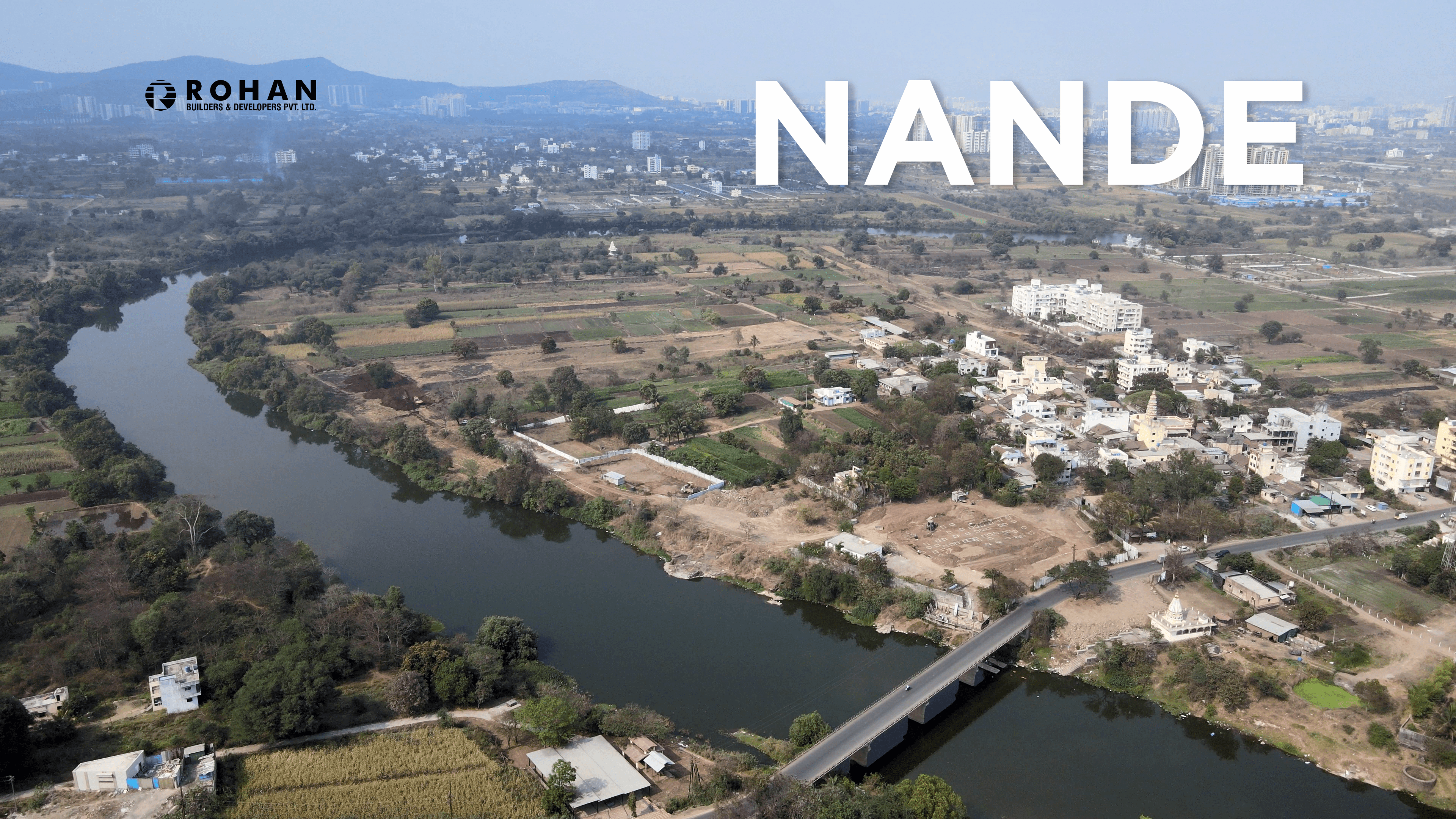

Nande – The Address for Nature-Inspired Living

05 February 2024

The pandemic significantly impacted our mental, physical, and social health. Staying locked-up in the ...

Read More

+91

+91 +672

+672 +82

+82