Blog

Key initiatives by Govt. of India to boost the Housing sector

15 June 2017

With the commencement of the year 2017, there have been many optimistic amendments and policies defined by the Government of India which intend to form a strong foundation with the help of intelligent economic management, eventually resulting in a robust economy. As regards to real estate sector, there have been many policy amendments and regulations that aim to cause a long-term potential impact on the real estate sector.

These key initiatives are imposed on the real estate sector to promote transparency, gain confidence of buyers as well as real estate builders and to boost the capital inflows from several institutional investors. With many of these policies being implemented at different levels, we can see some positive effects and recovery of this sector already.

Along with demonetization, let’s see which policies will completely transform the structure of how real estate sector works in future.

Amendments in Real Estate Investment Trusts (REITs) Regulations- September 2014

After substantial amendments, Real Estate Investment Trusts (REITs) or Infrastructure Investment Trusts (InvIT) regulations were finally legislated by the Government of India in September 2014. Real Estate, being a capital-intensive sector with a very constricted scope for the developers and owners to raise funds, the REITs regulations- as an investment vehicle, will offer a positive breakthrough to this sector. REITs will be providing a guide for individual investors, where they can receive a share from income generated via commercial real estate ownership- without really going out there and purchasing commercial real estate.

REIT as an investment vehicle may own income-producing real estate properties likes shopping malls, office buildings, resorts, hotels, mortgages, warehouses, apartments, etc. Most key benefits of enacting REIT would be enhanced transparency, stable flow of dividends, proficient administration and an alternative source of capital which would be accessible. As regards to developers, particularly those who are troubled with debt, can now find a radical way to raise capital through REIT and can also exit investments.

Securities and Exchange Board of India (SEBI) has delineated comprehensive guidelines that encompasses following aspects: Eligibility criteria for the sponsor who sets up REIT, the manager of trust as well as Trustee, Investment criteria like ratio of the value of income-producing properties as well as other assets, policies regarding distribution of dividends, minimum capital mandatory for IPO (initial public offer), etc. REITs differ from other housing companies in terms of their obligatory criteria to acquire and develop their assets deliberately as a part of their own investment plan, and not for reselling the assets after its development.

For a company to qualify as a REIT, it needs to have majority of its assets and revenue associated to the real estate investment and also it is mandatory to distribute minimum 90% of their REIT sale proceeds to the shareholders as dividends, twice a year. Other benefits of REIT include complete transparency regarding annual valuation and regularly updating it every six months, promoting diversification due to the investment in at least 2 projects with 60% asset value in one of the project, lower risk due to the fact that 80% of the assets need to be invested in income-generating and completed projects.

Real Estate (Regulation and Development) Act 2016 (RERA) – May 2017

The Real Estate (Regulation and Development) Act, 2016 is an Act proposed by the Parliament of India with the intention to protect home-buyers as well as promote increase in investments for the real estate sector. This Act makes it obligatory for all the residential as well as commercial real estate projects with land above 500 square meters or more than 8 apartments, to register with RERA (Real Estate Regulatory Authority), if initiating a project. This will create extreme transparency in the whole process of project execution as well as marketing.

As regards to the ongoing real estate projects which have not yet received completion certificate till the date of commencement of this Act, they will have to pursue their registration with RERA within the course of 3 months.

Application for this RERA registration ought to be approved or rejected in the due course of 30 days from the applied date by RERA. Promoters of the projects that have been successfully registered with RERA, will then receive a registration number, login id and password where they will be filling up all the necessary info on the RERA’s official website. In case of failure in registration, a penalty of about 10% of the project cost or 3 years of imprisonment can be imposed by the officials.

Any housing agents who seek selling or purchase of properties, first need to pursue registration from RERA. After registration, these real estate agents will be provided with a single registration number for each state, which they ought to quote in every sale initiated by them. This Act will help RERAs to regulate and monitor transactions executed for both residential as well as commercial projects thoroughly and will ensure whether the projects are being completed timely for effective handover.

Benami Transaction Prohibition (Amendment) Act 2016 – November 2016

With several efforts instigated by Government of India to eradicate black money and money laundering practices in India, Amendments in the Benami Transaction Prohibition Act 2016 will be one of the significant measures.

This Act amends the already existing Benami Transactions Act, 1988 and the modifications cover following aspects: Empowering of specific authorities to tentatively attach Benami Properties which can be detained sooner or later, Punishment to the Guilty of Benami Transactions imposed by competent court, for the course of minimum 1 year which can be eventually extended to 7 years with liability to pay fine that can be extended up to 25% of the fair market value of their Benami property. It also empowers the administration to seize the deposits of people trying to use other accounts for converting their unaccounted money into white money.

The BTP Act will hopefully exterminate the usual practice of people of investing their black money in purchasing Benami Properties in order to evade taxation. For real estate sector, this Act will have long-term positive effects, as all of the transactions will be carried out in the name of the real owner. This will boost transparency in the residential market and lower risks, which will eventually hike up residential properties transactions.

Moreover, real estate owners can conquer confidence of lenders. For short term, it might decrease the transaction volumes, but for long-term, it will make real estate sector much more stabilized investment destination, enhance flow of transactions that are in accordance with ethical standards and will boost international institutional investors participation in the real estate sector as well.

Land Acquisition, Rehabilitation and Resettlement (LARR) Bill – January 2014

Land Acquisition has always been a great challenge for Administration as well as businesses. Amendment Ordinance in the LARR Bill was finally passed by LokSabha in March 2015. These amendments are intended to regulate land acquisition and also state a comprehensive rules and procedure on granting compensation, resettlement and rehabilitation to the affected people of the country.

Some of the crucial amendments that were covered in the Bill are as follows: Land Acquisition can be only executed for the industrial corridors proposed by the Government, whatever land is acquired for the industrial corridor cannot go beyond 1 km on either side of nominated road or railway line, government aims to safeguard the interests of farmers with land beyond this stated limit, If project carried out on any land has been acquired from a farmer, then compulsory employment for one member of his family will be granted.

As regards to real estate, the effect of amendments in the LARR Bill will positively streamline the whole procedure of land acquisition and the acquired land can be utilized for the growth of industrial corridors along major expressways and highways. The removal of bottlenecks for social infrastructure projects like consent clause, will now ease the restrictions laid on by land acquisition, thus promoting smooth development of these projects. This also applies to acquiring multi-cropped property.

To conclude, the amendments in the LARR Bill proposed by the Government will benefit the real estate massively, as now for all the ongoing projects in India, there will be an upturn in number of projects and faster passing of land. But, the proposed amendment ordinance has been strongly opposed by the opposition parties and has been facing many problems, since.

Pradhan MantriAwasYojana – Credit Linked Subsidy Scheme (CLSS) – June 2015

CLSS is offered for EWS (Economical Weaker Section), MIG (Middle Income Group), LIG (Lower Income Group) categories under the PMAY. This interest subsidy scheme namely CLSS (Credit Linked Subsidy Scheme) has been put forward by MoHUPA (Ministry of Housing and Urban Poverty Alleviation) and was announced by the Prime Minister of India with an optimistic vision of ‘Housing for All by the year 2022’.

Under this scheme, the beneficiary is eligible to benefit from interest subsidy on buying/constructing or expansion/enhancement of a house. Some of the significant criteria and features of this scheme include: The benefit of the interest subsidy is calculated for 20 years, all the benefits are available for first-time property purchase, applicant ought to be of immediate family consisting of a spouse, self and unmarried kids only, Women Ownership is obligatory under EWS and LIW category for buying new house.

To be precise, under MIG category, there are 2 subcategories viz. MIG-I, where the beneficiary will get 4% interest subsidy on a loan sum of about 9 lakh and carpet area has to be 90 sq. meters. Where the MIG-II category persons can get up to 3% subsidy on loan amount of up to 12 lakh and the carpet area is to be 110 sq. meters. For those who need an additional loan, the lender might provide it, but at a non-subsidized rate.

Individuals can avail PMAY benefits who wish to purchase a new house from a developer and even from the secondary market via repurchase. For people who already own a house but wishes to avail PMAY benefit can do so, as Government has declared enhancement/expansion housing to the ‘pucca’ house under CLSS as well.

You can avail PMAY linked loans via any lending bodies like State Cooperative Banks, Urban Cooperative Banks, Housing Finance companies, Scheduled Commercial banks, so on.

Amendment of Section 80IB: Income Tax Act- Feb, 2016

Section 80-IB of the Income Tax Act is instigated to promote construction of real estate projects and to stamp out the common issue of shortage in dwelling units, especially for lower and middle-class people of the society. The 80IB assures 100% deductions (tax relief) to builders who are promoting Affordable Housing Schemes in India.

This Amendment designates that an assessee (a person who is liable to pay any tax or any amount under this Act) involved in developing or building affordable housing projects will be eligible for a tax deduction equal to 100% of profits and gains derived from such businesses from the gross total income.

But there are some terms and conditions to be fulfilled to be eligible for this deduction. Some of the conditions are as follows: the project should be approved from 1st June 2016 to 31st March 2019, Completion Certificate must be attained within 3 years from date of approval, for more than one approval for the same project- the three years of period will be considered from the date of first approval and so on.

Location and project sizes required to avail these deductions are: For metro cities, the plot size of the land must not be less than 1000 sq. meters and for non-metro cities, it must not be less than 2000 sq. meters. Additionally, in metro cities, a project must not use less than 90% of the permissible FAR (floor area ratio) as per Government rules; which for non-metro cities- must not be less than 80%. There are other eligible criteria delineated concerning the build-up area of the shop or commercial establishments and residential units as well.

All in all, with these Amended benefits under section 80IB of Income Tax Act, the real estate developers are expected to build more Affordable Housing Projects and contribute towards the ‘Housing for all by 2022’ vision and help form a better India.

Future significances of Effective Policies on Real Estate Sector:

More than 3 years have passed since the Prime Minister’s election, and the country has been witnessing some positive impacts of different Key Policies initiated by the Government. With core sectors leading towards development, there are also many bottlenecks and challenges persisting in the progression of these Acts.

Although, the real impact of these Policies and reforms enacted by Government can only be judged when they are effectively executed for about 3 to 5 years, however, the positive objective of the Government still influences us to believe that these initiatives are progressing in the exact direction of development. On a more comprehensive note, these policies and reforms are intended to improve governance, eradicate fraudulence and corruption, streamline taxation structure and boost development of major sectors like real estate.

TOP Blog

Why Spaciousness Beyond Square Feet Matters

04 February 2026

Space is usually measured in square feet. But experienced in far quieter ways. Most people have walked into homes that inst...

Read More

What We Mean When We Say a Home is Well-Ventilated

04 February 2026

People don't usually mean it literally when they say a home is "breathable." They're talking about how it feels to live there,...

Read More

Why Thane Works the Way It Does: Location Highlights

04 February 2026

Some places slowly make life easier. Not because they try to. But because they’ve grown that way. Thane is one of those cit...

Read More

Rohan Builders Wins Best CSR Initiative at National CREDAI Awards 2025

20 January 2026

We are excited to share a milestone that truly means a lot to us. Rohan Builders has been awarded the 1st Prize for Best CSR I...

Read More

Viman Nagar: The Gateway of Growth in Pune

18 June 2025

Viman Nagar used to be a calm neighbourhood that was renowned once only for being close to the Pune Airport. However, over the...

Read More

A Note On West Pune’s Infrastructure Developments

12 December 2022

Western Pune includes the suburbs of Baner, Aundh, Balewadi and Hinjawadi among others. Baner and Aundh are known as some of t...

Read More

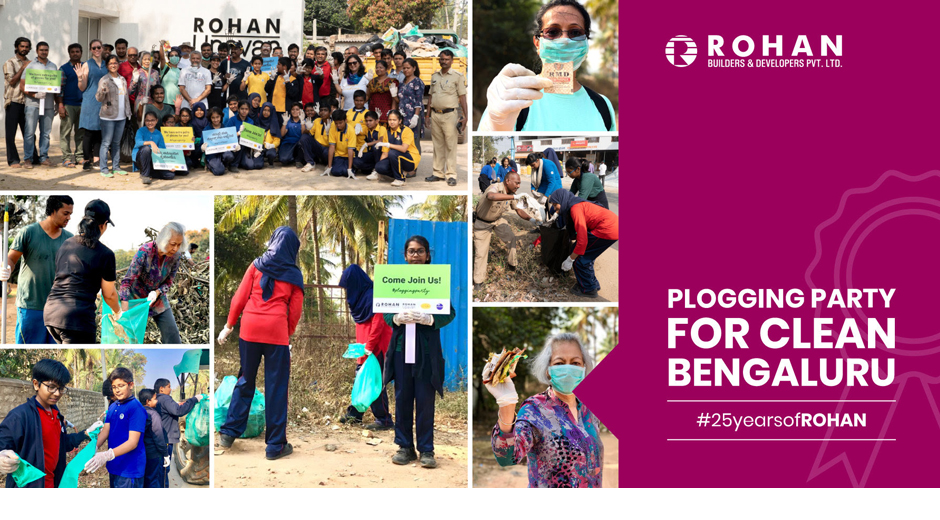

Clean Bengaluru Message by Rohan Builders Plogging Party

20 February 2019

A "Clean Bengaluru" message was unequivocally reaffirmed by Rohan Builders, sixty enthusiastic students and citizens on 16th F...

Read More

Future homes – 3D printing in Construction & Real estate industry.

20 February 2019

Two events, small in bearing yet big on viable impact have occurred very recently in the construction industry Even though the...

Read More

Hennur Road – The housing location of pride in north Bangalore

27 October 2017

For someone tracking the growth of the city (or megacity) of Bangalore over the years, the last two decades will probably occu...

Read More

+91

+91 +672

+672 +82

+82