Blog

How will GST affect top builders in Bangalore?

23 June 2017

The real estate sector, as one of India’s chief contributors and backbone of national GDP, will be immensely affected due to some significant actions instigated by the Government of India. This includes the most awaited tax reforms namely GST (Goods and Service Tax) Bill followed by the commencement of RERA and demonetization.

These critical initiations will now create transparency in all of the real estate transactions and will effectively eradicate illegitimate happenings. Being the most drastic taxation reform, GST Bill will also have a vital role in changing India’s economic projections. Let’s see how GST would impact real estate developers as well as customers and what is in store for them.

What is Goods and Service Tax?

GST (Goods and Service Tax) is a single comprehensive indirect tax applied on production, sales and consumption of goods and services all throughout India aimed to replace several other taxes levied by the state and central government. Meaning, it will amalgamate CST, VAT, Service Tax, Central Excise Duty, Purchase Tax, and many more into a single tax structure i.e. GST. This will exterminate double taxation activities and simplify overall national market. Likewise, this simplification of tax might assist administration to work more easily.

GST will be levied on all the transactions, including import of goods and services. A Dual GST model will be adopted shortly, where the taxation will be scrutinised by Union and State governments. Central Government will levy CGST (Central Goods and Service Tax) and State government will levy SGST (State Goods and Service Tax) on all transactions executed within any single state of India. As regards to imported goods and inter-state dealings, Central Government will levy IGST (Integrated Goods and Service Tax) for easier progression.

As a consumption-based tax, GST will be paid to the state where the goods or services are being used rather than the state where they were manufactured. Formerly, State Governments were forced to connect with several other state governments to mass tax revenue. But, from this time, the tax collection procedures for State Governments will be prominently simplified, as they just have to collect the tax payable to them from Central Government itself.

GST Council decides to configure four-tier GST tax system, viz. 5%, 12%, 18% and 28%. From which, the lower tax rates will be levied on necessary products and highest rates will be levied on luxury and de-merit goods like tobacco, junk food, etc. The GST is considered to roll out on or after 1st July 2017.

How GST will affect Top Builders in Bangalore?

Apart from few unclear issues related to the real sector like what will be the prospect of affordable housing, GST still has some benefits in hand for developers and buyers to some extent. Implementation of GST will reduce levies for developers as multiple layers of taxes will be encompassed within single tax structure. Formerly, builders were liable to pay loads of taxes like Excise Duty, Customs Duty, CST, etc. while their project is under procurement stage. These taxes cover up about 10% of actual value of the property. But with GST, now the labour, money and time invested in these procedures will be much lesser. This will also reduce the cost of construction.

GST Council’s decision to levy tax rate with full ITC (Input Tax Credit) will positively affect builders as they can claim credit on tax already paid on the purchases. Previous taxation structure did not allow the construction sector to gain any benefits through input tax. With GST, now one can reap credits on whatever tax was paid on raw materials. Further, this might cause to neutralise the tax incidence for this particular sector. Builders might pass this benefit onto its customers and the overall price will then decrease at buyer’s end. However preparedness of construction sector will be hurdle for Input Tax Credit Mechanism.

What changes a builder will be experiencing after commencement of GST? Builders all across India, including top builders in Bangalore will be experiencing enhanced cash flow and might also expect the demands to hike up. Which is why, there will be effective rise in sales providing a scope for this sector to be more stable and developed.

What will be the ever-lasting effects of GST on builders? For a long time now this sector has been overloaded with myriads of taxes and there are also many unorganized builders who just do not refrain from corrupt practices. GST, together with RERA, will demand this sector to be more transparent and practice enhanced cost evaluation. Free flow of input tax credits towards builders will also increase margin in their hands.

Indirectly, real estate sector will also contribute towards the growth in economy of India. GST is expected to boost up the activities of builders and retain their growth, all after a devastating fall our economy has been through.

With current taxation structure, builders suffer through double taxation. The products they are procuring to build their projects cost them up to 25% of cost of products they are buying. Due to GST, it is expected, there will be an end to double taxation.

Additionally, the hike in tax rate for major inputs is seen to be very minimal. Previously, the indirect taxes on steel was up to 17% which will be hiked to 18% under GST, whereas regarding cement it was approximately 24%, changing to 28% under GST.

GST for under Construction Projects is standardized to 12% in case the Land Value has been included in consideration and 18% without land value.

How GST will affect property buyers?

For projects under-construction, GST is intended to streamline full taxation structure and make its execution easier. A property buyer will now have to pay 12% GST to buy a home that is under-construction. Customers were unclear as to how much of VAT or Service Tax has been covered when the final transaction value of a property was introduced to them. All they got to count on is the sales agreement clauses. Though VAT is a state levy and its tax rate completely varies state to state, the service tax, however, is a Central tax levied at 15%. Hence, current tax liabilities on home purchase are high and also contain mind-bending complications.

With GST, buyers will have clear idea as to what is the structure of tax and will have better understandings to question the dealer in detail. This will prevent most of the home buyers from blindly investing in the value of a property and thoroughly study what taxes they are actually paying for.

Concerning already completed projects, i.e. ready-to-move properties, customers might not face any major impacts or alteration in their existing tax liabilities, as GST is aimed to immensely affect the projects that are under-construction or the ones that have proposed for building. However, with builders claiming input tax credits, they might pass on these relaxations for buyers to avail, which is a relief.

Conclusion:

With amalgamation of RERA along with GST, the real estate sector will be majorly impacted in the long run. We might get to witness some critical changes leading to transparency and economy growth caused due to hiked up buyer confidence. Current taxation structure calls for multiple taxation and poor cash flow. When GST comes into effect, it would allow efficient flow of money and transparency in all of the transactions carried out. GST is expected to be constructive for both buyers as well as developers, although buyers might have to pay high prices for properties under-construction, this can be still be neutralised if the developer passes on the benefits of input tax.

Several well-established builders in metropolitan cities including Top Builders in Bangalore will be experiencing low tax effect than the existing one, which is a happy notion! GST’s audit track will be great in monitoring and regulating the real estate sector. However, it might be too early to frame out future outcomes; the positive effects will be evident only after 3 to 5 years of GST enactment.

TOP Blog

Why Spaciousness Beyond Square Feet Matters

04 February 2026

Space is usually measured in square feet. But experienced in far quieter ways. Most people have walked into homes that inst...

Read More

What We Mean When We Say a Home is Well-Ventilated

04 February 2026

People don't usually mean it literally when they say a home is "breathable." They're talking about how it feels to live there,...

Read More

Why Thane Works the Way It Does: Location Highlights

04 February 2026

Some places slowly make life easier. Not because they try to. But because they’ve grown that way. Thane is one of those cit...

Read More

Rohan Builders Wins Best CSR Initiative at National CREDAI Awards 2025

20 January 2026

We are excited to share a milestone that truly means a lot to us. Rohan Builders has been awarded the 1st Prize for Best CSR I...

Read More

Viman Nagar: The Gateway of Growth in Pune

18 June 2025

Viman Nagar used to be a calm neighbourhood that was renowned once only for being close to the Pune Airport. However, over the...

Read More

A Note On West Pune’s Infrastructure Developments

12 December 2022

Western Pune includes the suburbs of Baner, Aundh, Balewadi and Hinjawadi among others. Baner and Aundh are known as some of t...

Read More

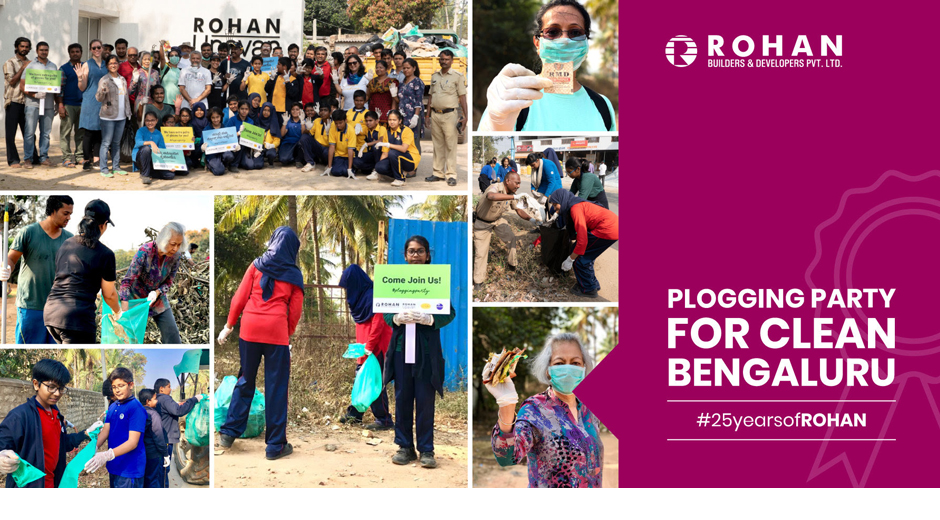

Clean Bengaluru Message by Rohan Builders Plogging Party

20 February 2019

A "Clean Bengaluru" message was unequivocally reaffirmed by Rohan Builders, sixty enthusiastic students and citizens on 16th F...

Read More

Future homes – 3D printing in Construction & Real estate industry.

20 February 2019

Two events, small in bearing yet big on viable impact have occurred very recently in the construction industry Even though the...

Read More

Hennur Road – The housing location of pride in north Bangalore

27 October 2017

For someone tracking the growth of the city (or megacity) of Bangalore over the years, the last two decades will probably occu...

Read More

+91

+91 +672

+672 +82

+82